Great addition to any home

Comes in a range of styles

Available in multiple sizes

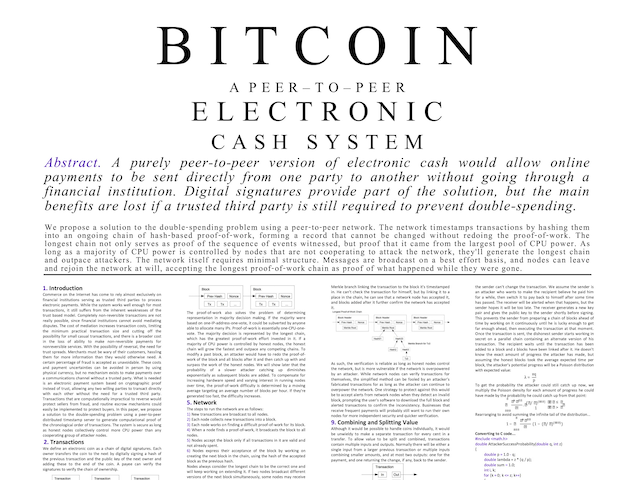

Bitcoin White Paper

比特幣白皮書

Bitcoin White Paper

比特幣白皮書

繁中/Chinese

B002

Great addition to any home

Comes in a range of styles

Available in multiple sizes

描述

倉庫位置:link

作者:中本聰 satoshin@gmx.com www.bitcoin.org 2008.10.31.

Abstract. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they’ll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

摘要 :一個純粹的點對點版本的電子現金系統,將允許線上支付直接從一方傳送到另一方,而無需通過金融機構。數字簽名雖然提供了部分解決方案,但,若是仍然需要被信任的第三方來防止雙重支付的話,那麼電子支付的主要優勢就被抵消了。我們提出一個方案,使用點對點網路去解決雙重支付問題。點對點網路將為每筆交易標記時間戳,方法是:把交易的雜湊資料錄入一個不斷延展的、以雜湊為基礎的工作量證明鏈上,形成一個如非完全重做就不可能改變的記錄。最長鏈,一方面用來證明已被見證的事件及其順序,與此同時,也用來證明它來自於最大的 CPU 運算能力池。只要絕大多數 CPU 運算能力被良性節點控制 —— 即,它們不與那些嘗試攻擊網路的節點合作 —— 那麼,良性節點將會生成最長鏈,並且在速度上超過攻擊者。這個網路本身需要最小化的結構。資訊將以最大努力為基本去傳播,節點來去自由;但,加入之時總是需要接受最長的工作量證明鏈作為它們未參與期間所發生之一切的證明。

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for non-reversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.

網際網路商業幾乎完全依賴金融機構作為可信第三方去處理電子支付。雖然針對大多數交易來說,這個系統還算不錯,但,它仍然被基於信任的模型所固有的缺陷所拖累。完全不可逆轉的交易實際上並不可能,因為金融機構不能避免仲裁爭議。仲裁成本增加了交易成本,進而限制了最小可能交易的規模,且乾脆阻止了很多小額支付交易。除此之外,還有更大的成本:系統無法為那些不可逆的服務提供不可逆的支付。逆轉的可能性,造成了對於信任的需求無所不在。商家必須提防著他們的顧客,麻煩顧客提供若非如此(如若信任)就並不必要的更多資訊。一定比例的欺詐,被認為是不可避免的。這些成本和支付不確定性,雖然在人與人之間直接使用物理貨幣支付的時候是可以避免的;但,沒有任何一個機制能在雙方在其中一方不被信任的情況下通過溝通渠道進行支付。

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers. In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions. The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.

我們真正需要的是一種基於加密證明而非基於信任的電子支付系統,允許任意雙方在不需要信任第三方的情況下直接交易。運算能力保障的不可逆轉交易能幫助賣家不被欺詐,而保護買家的日常擔保機制也很容易實現。在本論文中,我們將提出一種針對雙重支付的解決方案,使用點對點的、分散式的時間戳伺服器去生成基於運算能力的證明,按照時間順序記錄每條交易。此係統是安全的,只要誠實節點總體上相對於相互合作的攻擊者掌握更多的 CPU 運算能力。

We define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. A payee can verify the signatures to verify the chain of ownership.

我們將一枚電子硬幣定義為一個數字簽名鏈。一位所有者將一枚硬幣交給另一個人的時候,要通過在這個數字簽名鏈的末尾附加上以下數字簽名:上一筆交易的雜湊(hash,音譯,亦翻譯為“雜湊值”),以及新所有者的公鑰。收款人可以通過驗證簽名去驗證數字簽名鏈的所屬權。

The problem of course is the payee can’t verify that one of the owners did not double-spend the coin. A common solution is to introduce a trusted central authority, or mint, that checks every transaction for double spending. After each transaction, the coin must be returned to the mint to issue a new coin, and only coins issued directly from the mint are trusted not to be double-spent. The problem with this solution is that the fate of the entire money system depends on the company running the mint, with every transaction having to go through them, just like a bank.

這個路徑的問題在於收款人無法驗證曾經的所有者之中沒有人雙重支付過。常見的解決方案是引入一個可信的中心化權威方,或稱“鑄幣廠”,讓它去檢查每一筆交易是否存在雙重支付。每一次發生交易之後,硬幣必須返回到鑄幣廠,鑄幣廠再發行一枚新的硬幣。進而,只有鑄幣廠直接發行的硬幣才是可信的、未被雙重支付過的。這個解決方案的問題在於,整個貨幣系統的命運被拴在運營鑄幣廠的那個公司(就好像銀行那樣)身上,每一筆交易必須通過它。

We need a way for the payee to know that the previous owners did not sign any earlier transactions. For our purposes, the earliest transaction is the one that counts, so we don’t care about later attempts to double-spend. The only way to confirm the absence of a transaction is to be aware of all transactions. In the mint based model, the mint was aware of all transactions and decided which arrived first. To accomplish this without a trusted party, transactions must be publicly announced1, and we need a system for participants to agree on a single history of the order in which they were received. The payee needs proof that at the time of each transaction, the majority of nodes agreed it was the first received.

我們需要一種方式,可以讓收款人確認之前的所有者並沒有在任何之前的交易上簽名。就我們的目的而言,只有最早的交易是算數的,所以,我們並不關心其後的雙重支付企圖。確認一筆交易不存在的唯一方法是獲悉所有的交易。在鑄幣廠模型之中,鑄幣廠已然知悉所有的交易,並且能夠確認這些交易的順序。為了能在沒有“被信任的一方”參與的情況下完成以上任務,交易記錄必須被公開宣佈1 ,進而我們需要一個系統讓參與者們能在它們所接收到的交易歷史上取得唯一的共識。收款人將向此系統要求一項證明:在每筆交易發生之時,大多數節點能夠認同它是第一個被接收的。

The solution we propose begins with a timestamp server. A timestamp server works by taking a hash of a block of items to be timestamped and widely publishing the hash, such as in a newspaper or Usenet post2 3 4 5. The timestamp proves that the data must have existed at the time, obviously, in order to get into the hash. Each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it.

本解決方案起步於一種時間戳伺服器。時間戳伺服器是這樣工作的:為一組(block)記錄(items)的雜湊打上時間戳,而後把雜湊廣播出去,就好像一份報紙所做的那樣,或者像是在新聞組(Usenet)裡的一個帖子那樣2 3 4 5。顯然,時間戳能夠證明那資料在那個時間點之前已然存在,否則那雜湊也就無法生成。每個時間戳在其雜湊中包含著之前的時間戳,因此構成了一個鏈,且每個新的時間戳都為其之前的所有時間戳提供了強化。

To implement a distributed timestamp server on a peer-to-peer basis, we will need to use a proof-of-work system similar to Adam Back’s Hashcash6, rather than newspaper or Usenet posts. The proof-of-work involves scanning for a value that when hashed, such as with SHA-256, the hash begins with a number of zero bits. The average work required is exponential in the number of zero bits required and can be verified by executing a single hash.

為了實現一個基於點對點的分散式時間戳伺服器,我們需要使用類似亞當·伯克(Adam Back)的雜湊現金6那樣的一個工作量證明系統,而不是報紙或者新聞組帖子那樣的東西。所謂的工作量證明,就是去尋找一個數值;這個數值要滿足以下條件:為它提取雜湊數值之後 —— 例如使用 SHA-256 計算雜湊數值 —— 這個雜湊數值必須以一定數量的 0 開頭。每增加一個 0 的要求,將使得需要的工作量以指數級增加,並且,這個工作量的驗證卻只需通過計算一個雜湊。

For our timestamp network, we implement the proof-of-work by incrementing a nonce in the block until a value is found that gives the block’s hash the required zero bits. Once the CPU effort has been expended to make it satisfy the proof-of-work, the block cannot be changed without redoing the work. As later blocks are chained after it, the work to change the block would include redoing all the blocks after it.

在我們的時間戳網路中,我們是這樣實現工作量證明的:不斷提升在區塊之中一個隨機數(Nonce)的值,直到一個滿足條件的數值被找到;這個條件就是,這個區塊的雜湊以指定數量的 0 開頭。一旦 CPU 耗費運算能力所獲得的結果滿足工作量證明,那麼這個區塊將不能再被更改,除非重新付出之前的所有工作量。隨著新的區塊不斷被新增進來,改變某個區塊即意味著必須重新付出其後所有區塊乘載的全部工作量。

The proof-of-work also solves the problem of determining representation in majority decision making. If the majority were based on one-IP-address-one-vote, it could be subverted by anyone able to allocate many IPs. Proof-of-work is essentially one-CPU-one-vote. The majority decision is represented by the longest chain, which has the greatest proof-of-work effort invested in it. If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains. To modify a past block, an attacker would have to redo the proof-of-work of the block and all blocks after it and then catch up with and surpass the work of the honest nodes. We will show later that the probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added.

工作量證明同時也解決了如何決定誰能代表大多數做決定的問題。如果所謂的「大多數」是基於「一個IP地址一票」的方式決定的話,那麼任何一個可以搞定很多 IP 地址的人就可以被認為是「大多數」。工作量證明本質上來看,是「一個CPU一票」。所謂的「多數決」是由最長鏈所代表的,因為被投入最多工作量的鏈就是它。如果大多數 CPU 運算能力被誠實的節點所控制,那麼誠實鏈將成長最為迅速,其速度會遠超過其他競爭鏈。為了更改一個已經產生的區塊,攻擊者將不得不重新完成那個區塊以及所有其後區塊的的工作量證明,而後還要追上並超過誠實節點的工作。後文將展示為什麼一個緩慢的攻擊者能夠追上的可能性將隨著區塊的不斷增加而指數級降低。

To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they’re generated too fast, the difficulty increases.

為了應對硬體運算能力的不斷增加,以及隨著時間推進可能產生的節點參與數量變化,工作量證明難度由此決定:基於每小時產生的區塊數量的移動平均值調整。如果區塊生成得過快,那麼難度將會增加。

The steps to run the network are as follows:

- New transactions are broadcast to all nodes.

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

執行網路的步驟如下:

- 所有新的交易向所有節點廣播;

- 每個節點將新交易集合成一個區塊;

- 每個節點開始為此區塊找一個具備難度的工作量證明;

- 當某個區塊找到其工作量證明,它就要將此區塊廣播給所有節點;

- 眾多其他節點唯有當以下條件滿足才會接受這個區塊:其中所有的交易都是有效的,且未被雙重支付;

- 眾多節點向網路表示自己接受這個區塊的方法是:將此區塊當作下一個區塊的基底,以此區塊的雜湊值繼續計算下個區塊。

Nodes always consider the longest chain to be the correct one and will keep working on extending it. If two nodes broadcast different versions of the next block simultaneously, some nodes may receive one or the other first. In that case, they work on the first one they received, but save the other branch in case it becomes longer. The tie will be broken when the next proof-of-work is found and one branch becomes longer; the nodes that were working on the other branch will then switch to the longer one.

節點始終認為最長鏈是正確的那個,且會不斷向其附加新資料。若是有兩個節點同時向網路廣播了兩個不同版本的“下一個區塊”,有些節點會先接收到其中一個,而另外一些節點會先接收到另外一個。這種情況下,節點將在它們先接收到的那個區塊上繼續工作,但也會把另外一個分支儲存下來,以防後者成為最長鏈。當下一個工作量證明被找到,而其中的一個分支成為更長的鏈之後,這個暫時的分歧會被打消,在另外一個分支上工作的節點們會切換到更長的鏈上。

New transaction broadcasts do not necessarily need to reach all nodes. As long as they reach many nodes, they will get into a block before long. Block broadcasts are also tolerant of dropped messages. If a node does not receive a block, it will request it when it receives the next block and realizes it missed one.

新的交易不見得一定要廣播到達所有的節點。只要到達足夠多的節點,那麼沒多久這些交易就會被打包進一個區塊。區塊廣播也對訊息的丟失有容錯能力。如果一個節點並未接收到某個區塊,那麼這個節點會在它接收到下一個區塊的時候意識到自己錯失了之前的區塊,因此會發出補充那個遺失區塊的請求。

By convention, the first transaction in a block is a special transaction that starts a new coin owned by the creator of the block. This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them. The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.

按照約定,每個區塊的第一筆交易是一個特殊的交易,它會生成一枚新的硬幣,所屬權是這個區塊的生成者。這麼做,使得節點運行網路能有所獎勵,也提供了一種將硬幣發行到流通之中的方式 —— 需要這種方式,是因為這個系統中並沒有一個中心化機構負責發行硬幣。如此這般穩定地增加一定數量的新硬幣進入流通,就好像是黃金開採者不斷耗用他們的資源往流通之中增加黃金一樣。在我們的系統中,被耗用的資源是 CPU 工作時間和它們所用的電力。

The incentive can also be funded with transaction fees. If the output value of a transaction is less than its input value, the difference is a transaction fee that is added to the incentive value of the block containing the transaction. Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.

獎勵還可以來自交易費用。如果一筆交易的輸出值小於它的輸入值,那麼其中的差額就是交易費;而該交易費就是用來獎勵節點把該交易打包進此區塊的。一旦預定義數量的硬幣都已經進入流通,那麼獎勵將全面交由交易手續費來完成,且絕對不會有通貨膨脹。

The incentive may help encourage nodes to stay honest. If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

獎勵機制也可能會鼓勵節點保持誠實。如果一個貪婪的攻擊者能夠網羅比所有誠實節點都更多的 CPU 運算能力,他必須做出一個選擇:是用這些運算能力來把自己花出去的錢偷回來去欺騙別人呢?還是用這些運算能力去生成新的硬幣?他應該能夠發現按照規則行事是更划算的,當前規則使得他能夠獲得比所有其他人加起來都更多的硬幣,這顯然比暗中摧毀系統並使自己的財富化為虛無更划算。

Once the latest transaction in a coin is buried under enough blocks, the spent transactions before it can be discarded to save disk space. To facilitate this without breaking the block’s hash, transactions are hashed in a Merkle Tree257, with only the root included in the block’s hash. Old blocks can then be compacted by stubbing off branches of the tree. The interior hashes do not need to be stored.

如果一枚硬幣的最新交易已經被足夠多的區塊覆蓋,那麼,這枚硬幣在這筆交易之前的花費交易記錄可以被丟棄 —— 目的是為了節省磁碟空間。為了在不破壞該區塊的雜湊的前提下實現此功能,交易記錄的雜湊將被納入一個 Merkle 樹257之中,而只有樹根被納入該區塊的雜湊之中。通過砍掉樹枝方法,老區塊即可被壓縮。內部的雜湊並不需要被儲存。

A block header with no transactions would be about 80 bytes. If we suppose blocks are generated every 10 minutes, 80 bytes * 6 * 24 * 365 = 4.2MB per year. With computer systems typically selling with 2GB of RAM as of 2008, and Moore’s Law predicting current growth of 1.2GB per year, storage should not be a problem even if the block headers must be kept in memory.

一個沒有任何交易記錄的區塊頭大約是 80 個位元組。假設每十分鐘產生一個區塊,80 位元組乘以 6 乘以 24 乘以 365,等於每年 4.2M。截止 2008 年,大多數在售的計算機配有 2GB 記憶體,而按照摩爾定律的預測,每年會增加 1.2 GB,即便是區塊頭必須儲存在記憶體之中也不會是什麼問題。

It is possible to verify payments without running a full network node. A user only needs to keep a copy of the block headers of the longest proof-of-work chain, which he can get by querying network nodes until he’s convinced he has the longest chain, and obtain the Merkle branch linking the transaction to the block it’s timestamped in. He can’t check the transaction for himself, but by linking it to a place in the chain, he can see that a network node has accepted it, and blocks added after it further confirm the network has accepted it.

即便不用執行一個完整網路節點也有可能確認支付。使用者只需要有一份工作量證明的最長鏈的區塊頭複本 —— 他可以通過查詢線上節點確認自己擁有的複本確實來自最長鏈 —— 而後獲取 Merkle 樹的樹枝節點,進而連線到這個區塊被打上時間戳時的交易。使用者並不能自己檢查交易,但,通過連結到鏈上的某個地方,他可以看到某個網路節點已經接受了這筆交易,而此後加進來的區塊進一步確認了網路已經接受了此筆交易。

As such, the verification is reliable as long as honest nodes control the network, but is more vulnerable if the network is overpowered by an attacker. While network nodes can verify transactions for themselves, the simplified method can be fooled by an attacker’s fabricated transactions for as long as the attacker can continue to overpower the network. One strategy to protect against this would be to accept alerts from network nodes when they detect an invalid block, prompting the user’s software to download the full block and alerted transactions to confirm the inconsistency. Businesses that receive frequent payments will probably still want to run their own nodes for more independent security and quicker verification.

如此一來,只要誠實節點依然掌控整個網路,驗證即為可靠的。然而,如果網路被攻擊者所控制的時候,驗證就沒那麼可靠了。儘管網路節點可以自己驗證交易記錄,但是,只要攻擊者能夠繼續控制網路的話,那麼簡化版驗證方式可能會被攻擊者偽造的交易記錄所欺騙。應對策略之一是,客戶端軟體要接受來自網路節點的警告。當網路節點發現無效區塊的時候,即發出警報,在使用者的軟體上彈出通知,告知使用者下載完整區塊,警告使用者確認交易一致性。那些有高頻收付發生的商家應該會希望執行屬於自己的完整節點,以此保證更獨立的安全性和更快的交易確認。

Although it would be possible to handle coins individually, it would be unwieldy to make a separate transaction for every cent in a transfer. To allow value to be split and combined, transactions contain multiple inputs and outputs. Normally there will be either a single input from a larger previous transaction or multiple inputs combining smaller amounts, and at most two outputs: one for the payment, and one returning the change, if any, back to the sender.

儘管逐個地處理硬幣是可能的,但為每分錢設定一個單獨的交易是很笨拙的。為了允許價值的分割與合併,交易記錄包含多個輸入和輸出。一般情況下,要麼是以過去一筆金額較大的交易當作單一輸入,要麼是以多個小額交易組合輸入;然而,最多只會有兩個輸出:一個是支付(指向收款方),以及,如果必要的話,一個是找零(指向發款方)。

It should be noted that fan-out, where a transaction depends on several transactions, and those transactions depend on many more, is not a problem here. There is never the need to extract a complete standalone copy of a transaction’s history.

值得注意的是,“扇出”在這裡並不是問題 —— 所謂“扇出”,就是指一筆交易依賴於數筆交易,且這些交易又依賴於更多筆交易。從來就沒有必要去提取任何一筆交易的完整獨立的歷史複本。

The traditional banking model achieves a level of privacy by limiting access to information to the parties involved and the trusted third party. The necessity to announce all transactions publicly precludes this method, but privacy can still be maintained by breaking the flow of information in another place: by keeping public keys anonymous. The public can see that someone is sending an amount to someone else, but without information linking the transaction to anyone. This is similar to the level of information released by stock exchanges, where the time and size of individual trades, the “tape”, is made public, but without telling who the parties were.

傳統的銀行模型達成一定程度隱私保護的方式為:通過限制外人獲取交易者和可信第三方的資訊。出於對將所有交易記錄公開的需求否決了這種方法。但是,維持隱私可通過於另一處的切斷資訊流來實現 —— 公鑰匿名。公眾可以看到某某向某某轉賬了一定的金額,但是,沒有任何資訊將交易指向某個確定的人。這種資訊的揭露程度有點像股市交易,只有時間和各個交易的金額被公佈,但是,沒有人知道交易雙方都是誰。

As an additional firewall, a new key pair should be used for each transaction to keep them from being linked to a common owner. Some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner. The risk is that if the owner of a key is revealed, linking could reveal other transactions that belonged to the same owner.

還有另外一層防火牆:交易者應該針對每一筆新交易啟用一對新的公私鑰,以防止他人將這些交易連結到同一個所有者身上。有些多個輸入的交易依然難免被追溯,因為那些輸入必然會被識別出來自於同一個所有者。危險在於,如果一個公鑰的所有者被曝光之後,與之相關的所有其他交易都會被曝光。

We consider the scenario of an attacker trying to generate an alternate chain faster than the honest chain. Even if this is accomplished, it does not throw the system open to arbitrary changes, such as creating value out of thin air or taking money that never belonged to the attacker. Nodes are not going to accept an invalid transaction as payment, and honest nodes will never accept a block containing them. An attacker can only try to change one of his own transactions to take back money he recently spent.

假設一個場景,某個攻擊者正在試圖生成一個比誠實鏈更快的替代鏈。就算他成功了,也不會使當前系統置於模稜兩可的尷尬境地,即,他不可能憑空製造出價值,也無法獲取從未屬於他的錢。網路節點不會把一筆無效交易當作支付,而誠實節點也永遠不會接受一個包含這種支付的區塊。攻擊者最多只能修改屬於他自己的交易,進而試圖取回他已經花出去的錢。

The race between the honest chain and an attacker chain can be characterized as a Binomial Random Walk. The success event is the honest chain being extended by one block, increasing its lead by +1, and the failure event is the attacker’s chain being extended by one block, reducing the gap by -1.

誠實鏈和攻擊者之間的競爭可以用二項式隨機漫步來描述。成功事件是誠實鏈剛剛被添加了一個新的區塊,使得它的優勢增加了 ‘1’;而失敗事件是攻擊者的鏈剛剛被增加了一個新的區塊,使得誠實鏈的優勢減少了 ‘1’。

The probability of an attacker catching up from a given deficit is analogous to a Gambler’s Ruin problem. Suppose a gambler with unlimited credit starts at a deficit and plays potentially an infinite number of trials to try to reach breakeven. We can calculate the probability he ever reaches breakeven, or that an attacker ever catches up with the honest chain, as follows8:

p = probability an honest node finds the next block q = probability the attacker finds the next block q z = probability the attacker will ever catch up from z blocks behind

攻擊者能夠從落後局面追平的機率類似於賭徒破產問題。假設,一個拿著無限籌碼的賭徒,從虧空開始,允許他賭無限次,目標是填補上已有的虧空。我們能算出他最終能填補虧空的機率,也就是攻擊者能夠趕上誠實鏈的機率8,如下:

p = 誠實節點找到下一個區塊的機率. q = 攻擊者找到下一個區塊的機率. q z = 攻擊者落後 ‘z’ 個區塊卻依然能夠趕上的機率.

Given our assumption that ‘p > q’, the probability drops exponentially as the number of blocks the attacker has to catch up with increases. With the odds against him, if he doesn’t make a lucky lunge forward early on, his chances become vanishingly small as he falls further behind.

既然我們已經假定 ‘p > q’, 當攻擊者需要趕超的區塊數量越來越多,那麼其成功機率就會指數級下降。於贏面不利時,如果攻擊者沒有在起初就能幸運地做一個前移步刺,那麼他的勝率將在他進一步落後的同時消弭殆盡。

We now consider how long the recipient of a new transaction needs to wait before being sufficiently certain the sender can’t change the transaction. We assume the sender is an attacker who wants to make the recipient believe he paid him for a while, then switch it to pay back to himself after some time has passed. The receiver will be alerted when that happens, but the sender hopes it will be too late.

現在考慮一下一筆新交易的收款人需要等多久才能充分確定發款人不能更改這筆交易。我們假定發款人是個攻擊者,妄圖讓收款人在一段時間裡相信他已經支付對付款項,隨後將這筆錢再轉回給自己。發生這種情況時,收款人當然會收到警告,但發款人希望那時木已成舟。

The receiver generates a new key pair and gives the public key to the sender shortly before signing. This prevents the sender from preparing a chain of blocks ahead of time by working on it continuously until he is lucky enough to get far enough ahead, then executing the transaction at that moment. Once the transaction is sent, the dishonest sender starts working in secret on a parallel chain containing an alternate version of his transaction.

收款人生成了一對新的公私鑰,並在簽名前的一小段時間才將公鑰告知發款人。這樣可以防止一種情形:發款人提前通過不斷的運算去預先準備一連串的區塊,並且只要有足夠的運氣就能擁有足夠的領先,直到那時再執行交易。一旦款項已被發出,那個不誠實的發款人開始祕密地在另一條平行鏈上開工,試圖在其中加入一個反向版本的交易。

The recipient waits until the transaction has been added to a block and ‘z’ blocks have been linked after it. He doesn’t know the exact amount of progress the attacker has made, but assuming the honest blocks took the average expected time per block, the attacker’s potential progress will be a Poisson distribution with expected value:

收款人等到此筆交易被打包進區塊,並已經有 ‘z’ 個區塊被附加在其之後。他並不知道攻擊者的工作進展究竟如何,但是可以假定誠實區塊在每個區塊生成過程中耗費的平均時間;攻擊者的潛在進展符合 Poisson 分佈,其期望值為:

To get the probability the attacker could still catch up now, we multiply the Poisson density for each amount of progress he could have made by the probability he could catch up from that point:

為了算出攻擊者依然可以趕上的機率,我們要把每一個攻擊者已有的進展的 Poisson 密度乘以他可以從那一點能夠追上來的機率:

Rearranging to avoid summing the infinite tail of the distribution…

為了避免對密度分佈的無窮級數求和重新整理…

Converting to C code…

轉換為 C 語言程式……

#include <math.h>

double AttackerSuccessProbability(double q, int z)

{

double p = 1.0 - q;

double lambda = z * (q / p);

double sum = 1.0;

int i, k;

for (k = 0; k <= z; k++)

{

double poisson = exp(-lambda);

for (i = 1; i <= k; i++)

poisson *= lambda / i;

sum -= poisson * (1 - pow(q / p, z - k));

}

return sum;

}

Running some results, we can see the probability drop off exponentially with ‘z’.

獲取部分結果,我們可以看到機率隨著 ‘z’ 的增加指數級下降:

q=0.1

z=0 P=1.0000000

z=1 P=0.2045873

z=2 P=0.0509779

z=3 P=0.0131722

z=4 P=0.0034552

z=5 P=0.0009137

z=6 P=0.0002428

z=7 P=0.0000647

z=8 P=0.0000173

z=9 P=0.0000046

z=10 P=0.0000012

q=0.3

z=0 P=1.0000000

z=5 P=0.1773523

z=10 P=0.0416605

z=15 P=0.0101008

z=20 P=0.0024804

z=25 P=0.0006132

z=30 P=0.0001522

z=35 P=0.0000379

z=40 P=0.0000095

z=45 P=0.0000024

z=50 P=0.0000006

Solving for P less than 0.1%…

若是 P 小於 0.1%……

P < 0.001

q=0.10 z=5

q=0.15 z=8

q=0.20 z=11

q=0.25 z=15

q=0.30 z=24

q=0.35 z=41

q=0.40 z=89

q=0.45 z=340

We have proposed a system for electronic transactions without relying on trust. We started with the usual framework of coins made from digital signatures, which provides strong control of ownership, but is incomplete without a way to prevent double-spending. To solve this, we proposed a peer-to-peer network using proof-of-work to record a public history of transactions that quickly becomes computationally impractical for an attacker to change if honest nodes control a majority of CPU power. The network is robust in its unstructured simplicity. Nodes work all at once with little coordination. They do not need to be identified, since messages are not routed to any particular place and only need to be delivered on a best effort basis. Nodes can leave and rejoin the network at will, accepting the proof-of-work chain as proof of what happened while they were gone. They vote with their CPU power, expressing their acceptance of valid blocks by working on extending them and rejecting invalid blocks by refusing to work on them. Any needed rules and incentives can be enforced with this consensus mechanism.

我們提出了一個不必依賴信任的電子交易系統;起點是一個普通的使用數字簽名的硬幣框架開始,雖然它提供了健壯的所有權控制,卻無法避免雙重支付。為了解決這個問題,我們提出一個使用工作量證明機制的點對點網路去記錄一個公開的交易記錄歷史,只要誠實節點能夠控制大多數 CPU 運算能力,那麼攻擊者僅從運算能力方面就不可能成功篡改系統。這個網路的健壯在於它的無結構的簡單。節點們可以在很少協同的情況下瞬間同時工作。它們甚至不需要被辨認,因為訊息的路徑並非取決於特定的終點,訊息只需要被以最大努力為基本去傳播即可。節點來去自由,重新加入時,只需要接受工作量證明鏈,作為它們離線之時所發生之一切的證明。它們通過它們的 CPU 運算能力投票,通過不斷為鏈新增新的有效區塊、拒絕無效區塊,去表示它們對有效交易的接受與否。任何必要的規則和獎勵都可以通過這個共識機制來強制實施。

b-money Dai Wei (1998-11-01) http://www.weidai.com/bmoney.txt. ↩ ↩2

Design of a secure timestamping service with minimal trust requirements Henri Massias, Xavier Serret-Avila, Jean-Jacques Quisquater 20th Symposium on Information Theory in the Benelux (1999-05) http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.13.6228. ↩ ↩2 ↩3 ↩4

How to time-stamp a digital document Stuart Haber, W.Scott Stornetta Journal of Cryptology (1991) https://doi.org/cwwxd4 DOI: 10.1007/bf00196791. ↩ ↩2

Improving the Efficiency and Reliability of Digital Time-Stamping Dave Bayer, Stuart Haber, W. Scott Stornetta Sequences II (1993) https://doi.org/bn4rpx DOI: 10.1007/978-1-4613-9323-8_24. ↩ ↩2

Secure names for bit-strings Stuart Haber, W. Scott Stornetta Proceedings of the 4th ACM conference on Computer and communications security - CCS ’97 (1997) https://doi.org/dtnrf6 DOI: 10.1145/266420.266430. ↩ ↩2 ↩3 ↩4

Hashcash - A Denial of Service Counter-Measure Adam Back (2002-08-01) http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.15.8. ↩ ↩2

Protocols for Public Key Cryptosystems Ralph C. Merkle 1980 IEEE Symposium on Security and Privacy (1980-04) https://doi.org/bmvbd6 DOI: 10.1109/sp.1980.10006. ↩ ↩2

An Introduction to Probability Theory and its Applications William Feller John Wiley & Sons (1957) https://archive.org/details/AnIntroductionToProbabilityTheoryAndItsApplicationsVolume1. ↩ ↩2