M <Public Key 1> <Public Key 2> ... <Public Key N> N CHECKMULTISIG

Advanced Transactions and Scripting

Introduction

In the previous chapter, we introduced the basic elements of bitcoin transactions and looked at the most common type of transaction script, the P2PKH script. In this chapter we will look at more advanced scripting and how we can use it to build transactions with complex conditions.

First, we will look at multisignature scripts. Next, we will examine the second most common transaction script, Pay-to-Script-Hash, which opens up a whole world of complex scripts. Then, we will examine new script operators that add a time dimension to bitcoin, through timelocks. Finally, we will look at Segregated Witness, an architectural change to the structure of transactions.

Multisignature

Multisignature scripts set a condition where N public keys are recorded in the script and at least M of those must provide signatures to unlock the funds. This is also known as an M-of-N scheme, where N is the total number of keys and M is the threshold of signatures required for validation. For example, a 2-of-3 multisignature is one where three public keys are listed as potential signers and at least two of those must be used to create signatures for a valid transaction to spend the funds.

At this time, standard multisignature scripts are limited to at most 3 listed public keys, meaning you can do anything from a 1-of-1 to a 3-of-3 multisignature or any combination within that range. The limitation to 3 listed keys might be lifted by the time this book is published, so check the IsStandard() function to see what is currently accepted by the network. Note that the limit of 3 keys applies only to standard (also known as "bare") multisignature scripts, not to multisignature scripts wrapped in a Pay-to-Script-Hash (P2SH) script. P2SH multisignature scripts are limited to 15 keys, allowing for up to 15-of-15 multisignature. We will learn about P2SH in Pay-to-Script-Hash (P2SH).

The general form of a locking script setting an M-of-N multisignature condition is:

where N is the total number of listed public keys and M is the threshold of required signatures to spend the output.

A locking script setting a 2-of-3 multisignature condition looks like this:

2 <Public Key A> <Public Key B> <Public Key C> 3 CHECKMULTISIG

The preceding locking script can be satisfied with an unlocking script containing pairs of signatures and public keys:

<Signature B> <Signature C>

or any combination of two signatures from the private keys corresponding to the three listed public keys.

The two scripts together would form the combined validation script:

<Signature B> <Signature C> 2 <Public Key A> <Public Key B> <Public Key C> 3 CHECKMULTISIG

When executed, this combined script will evaluate to TRUE if, and only if, the unlocking script matches the conditions set by the locking script. In this case, the condition is whether the unlocking script has a valid signature from the two private keys that correspond to two of the three public keys set as an encumbrance.

A bug in CHECKMULTISIG execution

There is a bug in CHECKMULTISIG's execution that requires a slight workaround. When CHECKMULTISIG executes, it should consume M+N+2 items on the stack as parameters. However, due to the bug, CHECKMULTISIG will pop an extra value or one value more than expected.

Let’s look at this in greater detail using the previous validation example:

<Signature B> <Signature C> 2 <Public Key A> <Public Key B> <Public Key C> 3 CHECKMULTISIG

First, CHECKMULTISIG pops the top item, which is N (in this example "3"). Then it pops N items, which are the public keys that can sign. In this example, public keys A, B, and C. Then, it pops one item, which is M, the quorum (how many signatures are needed). Here M = 2. At this point, CHECKMULTISIG should pop the final M items, which are the signatures, and see if they are valid. However, unfortunately, a bug in the implementation causes CHECKMULTISIG to pop one more item (M+1 total) than it should. The extra item is disregarded when checking the signatures so it has no direct effect on CHECKMULTISIG itself. However, an extra value must be present because if it is not present, when CHECKMULTISIG attempts to pop on an empty stack, it will cause a stack error and script failure (marking the transaction as invalid). Because the extra item is disregarded it can be anything, but customarily 0 is used.

Because this bug became part of the consensus rules, it must now be replicated forever. Therefore the correct script validation would look like this:

0 <Signature B> <Signature C> 2 <Public Key A> <Public Key B> <Public Key C> 3 CHECKMULTISIG

Thus the unlocking script actually used in multisig is not:

<Signature B> <Signature C>

but instead it is:

0 <Signature B> <Signature C>

From now on, if you see a multisig unlocking script, you should expect to see an extra 0 in the beginning, whose only purpose is as a workaround to a bug that accidentally became a consensus rule.

Pay-to-Script-Hash (P2SH)

Pay-to-Script-Hash (P2SH) was introduced in 2012 as a powerful new type of transaction that greatly simplifies the use of complex transaction scripts. To explain the need for P2SH, let’s look at a practical example.

In [ch01_intro_what_is_bitcoin] we introduced Mohammed, an electronics importer based in Dubai. Mohammed’s company uses bitcoin’s multisignature feature extensively for its corporate accounts. Multisignature scripts are one of the most common uses of bitcoin’s advanced scripting capabilities and are a very powerful feature. Mohammed’s company uses a multisignature script for all customer payments, known in accounting terms as "accounts receivable," or AR. With the multisignature scheme, any payments made by customers are locked in such a way that they require at least two signatures to release, from Mohammed and one of his partners or from his attorney who has a backup key. A multisignature scheme like that offers corporate governance controls and protects against theft, embezzlement, or loss.

The resulting script is quite long and looks like this:

2 <Mohammed's Public Key> <Partner1 Public Key> <Partner2 Public Key> <Partner3 Public Key> <Attorney Public Key> 5 CHECKMULTISIG

Although multisignature scripts are a powerful feature, they are cumbersome to use. Given the preceding script, Mohammed would have to communicate this script to every customer prior to payment. Each customer would have to use special bitcoin wallet software with the ability to create custom transaction scripts, and each customer would have to understand how to create a transaction using custom scripts. Furthermore, the resulting transaction would be about five times larger than a simple payment transaction, because this script contains very long public keys. The burden of that extra-large transaction would be borne by the customer in the form of fees. Finally, a large transaction script like this would be carried in the UTXO set in RAM in every full node, until it was spent. All of these issues make using complex locking scripts difficult in practice.

P2SH was developed to resolve these practical difficulties and to make the use of complex scripts as easy as a payment to a bitcoin address. With P2SH payments, the complex locking script is replaced with its digital fingerprint, a cryptographic hash. When a transaction attempting to spend the UTXO is presented later, it must contain the script that matches the hash, in addition to the unlocking script. In simple terms, P2SH means "pay to a script matching this hash, a script that will be presented later when this output is spent."

In P2SH transactions, the locking script that is replaced by a hash is referred to as the redeem script because it is presented to the system at redemption time rather than as a locking script. Complex script without P2SH shows the script without P2SH and Complex script as P2SH shows the same script encoded with P2SH.

Locking Script |

2 PubKey1 PubKey2 PubKey3 PubKey4 PubKey5 5 CHECKMULTISIG |

Unlocking Script |

Sig1 Sig2 |

Redeem Script |

2 PubKey1 PubKey2 PubKey3 PubKey4 PubKey5 5 CHECKMULTISIG |

Locking Script |

HASH160 <20-byte hash of redeem script> EQUAL |

Unlocking Script |

Sig1 Sig2 <redeem script> |

As you can see from the tables, with P2SH the complex script that details the conditions for spending the output (redeem script) is not presented in the locking script. Instead, only a hash of it is in the locking script and the redeem script itself is presented later, as part of the unlocking script when the output is spent. This shifts the burden in fees and complexity from the sender to the recipient (spender) of the transaction.

Let’s look at Mohammed’s company, the complex multisignature script, and the resulting P2SH scripts.

First, the multisignature script that Mohammed’s company uses for all incoming payments from customers:

2 <Mohammed's Public Key> <Partner1 Public Key> <Partner2 Public Key> <Partner3 Public Key> <Attorney Public Key> 5 CHECKMULTISIG

If the placeholders are replaced by actual public keys (shown here as 520-bit numbers starting with 04) you can see that this script becomes very long:

2 04C16B8698A9ABF84250A7C3EA7EEDEF9897D1C8C6ADF47F06CF73370D74DCCA01CDCA79DCC5C395D7EEC6984D83F1F50C900A24DD47F569FD4193AF5DE762C58704A2192968D8655D6A935BEAF2CA23E3FB87A3495E7AF308EDF08DAC3C1FCBFC2C75B4B0F4D0B1B70CD2423657738C0C2B1D5CE65C97D78D0E34224858008E8B49047E63248B75DB7379BE9CDA8CE5751D16485F431E46117B9D0C1837C9D5737812F393DA7D4420D7E1A9162F0279CFC10F1E8E8F3020DECDBC3C0DD389D99779650421D65CBD7149B255382ED7F78E946580657EE6FDA162A187543A9D85BAAA93A4AB3A8F044DADA618D087227440645ABE8A35DA8C5B73997AD343BE5C2AFD94A5043752580AFA1ECED3C68D446BCAB69AC0BA7DF50D56231BE0AABF1FDEEC78A6A45E394BA29A1EDF518C022DD618DA774D207D137AAB59E0B000EB7ED238F4D800 5 CHECKMULTISIG

This entire script can instead be represented by a 20-byte cryptographic hash, by first applying the SHA256 hashing algorithm and then applying the RIPEMD160 algorithm on the result.

We use libbitcoin-explorer (bx) on the command-line to produce the script hash, as follows:

echo \ 2 \ [04C16B8698A9ABF84250A7C3EA7EEDEF9897D1C8C6ADF47F06CF73370D74DCCA01CDCA79DCC5C395D7EEC6984D83F1F50C900A24DD47F569FD4193AF5DE762C587] \ [04A2192968D8655D6A935BEAF2CA23E3FB87A3495E7AF308EDF08DAC3C1FCBFC2C75B4B0F4D0B1B70CD2423657738C0C2B1D5CE65C97D78D0E34224858008E8B49] \ [047E63248B75DB7379BE9CDA8CE5751D16485F431E46117B9D0C1837C9D5737812F393DA7D4420D7E1A9162F0279CFC10F1E8E8F3020DECDBC3C0DD389D9977965] \ [0421D65CBD7149B255382ED7F78E946580657EE6FDA162A187543A9D85BAAA93A4AB3A8F044DADA618D087227440645ABE8A35DA8C5B73997AD343BE5C2AFD94A5] \ [043752580AFA1ECED3C68D446BCAB69AC0BA7DF50D56231BE0AABF1FDEEC78A6A45E394BA29A1EDF518C022DD618DA774D207D137AAB59E0B000EB7ED238F4D800] \ 5 CHECKMULTISIG \ | bx script-encode | bx sha256 | bx ripemd160 54c557e07dde5bb6cb791c7a540e0a4796f5e97e

The series of commands above first encodes Mohammed’s multisig redeem script as a serialized hex-encoded bitcoin Script. The next bx command calculates the SHA256 hash of that. The next bx command hashes again with RIPEMD160, producing the final script-hash:

The 20-byte hash of Mohammed’s redeem script is:

54c557e07dde5bb6cb791c7a540e0a4796f5e97e

A P2SH transaction locks the output to this hash instead of the longer redeem script, using the locking script:

HASH160 54c557e07dde5bb6cb791c7a540e0a4796f5e97e EQUAL

which, as you can see, is much shorter. Instead of "pay to this 5-key multisignature script," the P2SH equivalent transaction is "pay to a script with this hash." A customer making a payment to Mohammed’s company need only include this much shorter locking script in his payment. When Mohammed and his partners want to spend this UTXO, they must present the original redeem script (the one whose hash locked the UTXO) and the signatures necessary to unlock it, like this:

<Sig1> <Sig2> <2 PK1 PK2 PK3 PK4 PK5 5 CHECKMULTISIG>

The two scripts are combined in two stages. First, the redeem script is checked against the locking script to make sure the hash matches:

<2 PK1 PK2 PK3 PK4 PK5 5 CHECKMULTISIG> HASH160 <redeem scriptHash> EQUAL

If the redeem script hash matches, the unlocking script is executed on its own, to unlock the redeem script:

<Sig1> <Sig2> 2 PK1 PK2 PK3 PK4 PK5 5 CHECKMULTISIG

Almost all the scripts described in this chapter can only be implemented as P2SH scripts. They cannot be used directly in the locking script of an UTXO.

P2SH Addresses

Another important part of the P2SH feature is the ability to encode a script hash as an address, as defined in BIP-13. P2SH addresses are Base58Check encodings of the 20-byte hash of a script, just like bitcoin addresses are Base58Check encodings of the 20-byte hash of a public key. P2SH addresses use the version prefix "5," which results in Base58Check-encoded addresses that start with a "3."

For example, Mohammed’s complex script, hashed and Base58Check-encoded as a P2SH address, becomes 39RF6JqABiHdYHkfChV6USGMe6Nsr66Gzw. We can confirm that with the bx command:

echo \ '54c557e07dde5bb6cb791c7a540e0a4796f5e97e'\ | bx address-encode -v 5 39RF6JqABiHdYHkfChV6USGMe6Nsr66Gzw

Now, Mohammed can give this "address" to his customers and they can use almost any bitcoin wallet to make a simple payment, as if it were a bitcoin address. The 3 prefix gives them a hint that this is a special type of address, one corresponding to a script instead of a public key, but otherwise it works in exactly the same way as a payment to a bitcoin address.

P2SH addresses hide all of the complexity, so that the person making a payment does not see the script.

Benefits of P2SH

The P2SH feature offers the following benefits compared to the direct use of complex scripts in locking outputs:

-

Complex scripts are replaced by shorter fingerprints in the transaction output, making the transaction smaller.

-

Scripts can be coded as an address, so the sender and the sender’s wallet don’t need complex engineering to implement P2SH.

-

P2SH shifts the burden of constructing the script to the recipient, not the sender.

-

P2SH shifts the burden in data storage for the long script from the output (which additionally to being stored on the blockchain is in the UTXO set) to the input (only stored on the blockchain).

-

P2SH shifts the burden in data storage for the long script from the present time (payment) to a future time (when it is spent).

-

P2SH shifts the transaction fee cost of a long script from the sender to the recipient, who has to include the long redeem script to spend it.

Redeem Script and Validation

Prior to version 0.9.2 of the Bitcoin Core client, Pay-to-Script-Hash was limited to the standard types of bitcoin transaction scripts, by the IsStandard() function. That means that the redeem script presented in the spending transaction could only be one of the standard types: P2PK, P2PKH, or multisig.

As of version 0.9.2 of the Bitcoin Core client, P2SH transactions can contain any valid script, making the P2SH standard much more flexible and allowing for experimentation with many novel and complex types of transactions.

You are not able to put a P2SH inside a P2SH redeem script, because the P2SH specification is not recursive. Also, while it is technically possible to include RETURN (see Data Recording Output (RETURN)) in a redeem script, as nothing in the rules prevents you from doing so, it is of no practical use because executing RETURN during validation will cause the transaction to be marked invalid.

Note that because the redeem script is not presented to the network until you attempt to spend a P2SH output, if you lock an output with the hash of an invalid redeem script it will be processed regardless. The UTXO will be successfully locked. However, you will not be able to spend it because the spending transaction, which includes the redeem script, will not be accepted because it is an invalid script. This creates a risk, because you can lock bitcoin in a P2SH that cannot be spent later. The network will accept the P2SH locking script even if it corresponds to an invalid redeem script, because the script hash gives no indication of the script it represents.

|

Warning

|

P2SH locking scripts contain the hash of a redeem script, which gives no clues as to the content of the redeem script itself. The P2SH transaction will be considered valid and accepted even if the redeem script is invalid. You might accidentally lock bitcoin in such a way that it cannot later be spent. |

Data Recording Output (RETURN)

Bitcoin’s distributed and timestamped ledger, the blockchain, has potential uses far beyond payments. Many developers have tried to use the transaction scripting language to take advantage of the security and resilience of the system for applications such as digital notary services, stock certificates, and smart contracts. Early attempts to use bitcoin’s script language for these purposes involved creating transaction outputs that recorded data on the blockchain; for example, to record a digital fingerprint of a file in such a way that anyone could establish proof-of-existence of that file on a specific date by reference to that transaction.

The use of bitcoin’s blockchain to store data unrelated to bitcoin payments is a controversial subject. Many developers consider such use abusive and want to discourage it. Others view it as a demonstration of the powerful capabilities of blockchain technology and want to encourage such experimentation. Those who object to the inclusion of nonpayment data argue that it causes "blockchain bloat," burdening those running full bitcoin nodes with carrying the cost of disk storage for data that the blockchain was not intended to carry. Moreover, such transactions create UTXO that cannot be spent, using the destination bitcoin address as a freeform 20-byte field. Because the address is used for data, it doesn’t correspond to a private key and the resulting UTXO can never be spent; it’s a fake payment. These transactions that can never be spent are therefore never removed from the UTXO set and cause the size of the UTXO database to forever increase, or "bloat."

In version 0.9 of the Bitcoin Core client, a compromise was reached with the introduction of the RETURN operator. RETURN allows developers to add 80 bytes of nonpayment data to a transaction output. However, unlike the use of "fake" UTXO, the RETURN operator creates an explicitly provably unspendable output, which does not need to be stored in the UTXO set. RETURN outputs are recorded on the blockchain, so they consume disk space and contribute to the increase in the blockchain’s size, but they are not stored in the UTXO set and therefore do not bloat the UTXO memory pool and burden full nodes with the cost of more expensive RAM.

RETURN scripts look like this:

RETURN <data>

The data portion is limited to 80 bytes and most often represents a hash, such as the output from the SHA256 algorithm (32 bytes). Many applications put a prefix in front of the data to help identify the application. For example, the Proof of Existence digital notarization service uses the 8-byte prefix DOCPROOF, which is ASCII encoded as 44 4f 43 50 52 4f 4f 46 in hexadecimal.

Keep in mind that there is no "unlocking script" that corresponds to RETURN that could possibly be used to "spend" a RETURN output. The whole point of RETURN is that you can’t spend the money locked in that output, and therefore it does not need to be held in the UTXO set as potentially spendable—RETURN is provably unspendable. RETURN is usually an output with a zero bitcoin amount, because any bitcoin assigned to such an output is effectively lost forever. If a RETURN is referenced as an input in a transaction, the script validation engine will halt the execution of the validation script and mark the transaction as invalid. The execution of RETURN essentially causes the script to "RETURN" with a FALSE and halt. Thus, if you accidentally reference a RETURN output as an input in a transaction, that transaction is invalid.

A standard transaction (one that conforms to the IsStandard() checks) can have only one RETURN output. However, a single RETURN output can be combined in a transaction with outputs of any other type.

Two new command-line options have been added in Bitcoin Core as of version 0.10. The option datacarrier controls relay and mining of RETURN transactions, with the default set to "1" to allow them. The option datacarriersize takes a numeric argument specifying the maximum size in bytes of the RETURN script, 83 bytes by default, which, allows for a maximum of 80 bytes of RETURN data plus one byte of RETURN opcode and two bytes of PUSHDATA opcode.

|

Note

|

RETURN was initially proposed with a limit of 80 bytes, but the limit was reduced to 40 bytes when the feature was released. In February 2015, in version 0.10 of Bitcoin Core, the limit was raised back to 80 bytes. Nodes may choose not to relay or mine RETURN, or only relay and mine RETURN containing less than 80 bytes of data. |

Timelocks

Timelocks are restrictions on transactions or outputs that only allow spending after a point in time. Bitcoin has had a transaction-level timelock feature from the beginning. It is implemented by the nLocktime field in a transaction. Two new timelock features were introduced in late 2015 and mid-2016 that offer UTXO-level timelocks. These are CHECKLOCKTIMEVERIFY and CHECKSEQUENCEVERIFY.

Timelocks are useful for postdating transactions and locking funds to a date in the future. More importantly, timelocks extend bitcoin scripting into the dimension of time, opening the door for complex multistep smart contracts.

Transaction Locktime (nLocktime)

From the beginning, bitcoin has had a transaction-level timelock feature. Transaction locktime is a transaction-level setting (a field in the transaction data structure) that defines the earliest time that a transaction is valid and can be relayed on the network or added to the blockchain. Locktime is also known as nLocktime from the variable name used in the Bitcoin Core codebase. It is set to zero in most transactions to indicate immediate propagation and execution. If nLocktime is nonzero and below 500 million, it is interpreted as a block height, meaning the transaction is not valid and is not relayed or included in the blockchain prior to the specified block height. If it is greater than or equal to 500 million, it is interpreted as a Unix Epoch timestamp (seconds since Jan-1-1970) and the transaction is not valid prior to the specified time. Transactions with nLocktime specifying a future block or time must be held by the originating system and transmitted to the bitcoin network only after they become valid. If a transaction is transmitted to the network before the specified nLocktime, the transaction will be rejected by the first node as invalid and will not be relayed to other nodes. The use of nLocktime is equivalent to postdating a paper check.

Transaction locktime limitations

nLocktime has the limitation that while it makes it possible to spend some outputs in the future, it does not make it impossible to spend them until that time. Let’s explain that with the following example.

Alice signs a transaction spending one of her outputs to Bob’s address, and sets the transaction nLocktime to 3 months in the future. Alice sends that transaction to Bob to hold. With this transaction Alice and Bob know that:

-

Bob cannot transmit the transaction to redeem the funds until 3 months have elapsed.

-

Bob may transmit the transaction after 3 months.

However:

-

Alice can create another transaction, double-spending the same inputs without a locktime. Thus, Alice can spend the same UTXO before the 3 months have elapsed.

-

Bob has no guarantee that Alice won’t do that.

It is important to understand the limitations of transaction nLocktime. The only guarantee is that Bob will not be able to redeem it before 3 months have elapsed. There is no guarantee that Bob will get the funds. To achieve such a guarantee, the timelock restriction must be placed on the UTXO itself and be part of the locking script, rather than on the transaction. This is achieved by the next form of timelock, called Check Lock Time Verify.

Check Lock Time Verify (CLTV)

In December 2015, a new form of timelock was introduced to bitcoin as a soft fork upgrade. Based on a specification in BIP-65, a new script operator called CHECKLOCKTIMEVERIFY (CLTV) was added to the scripting language. CLTV is a per-output timelock, rather than a per-transaction timelock as is the case with nLocktime. This allows for much greater flexibility in the way timelocks are applied.

In simple terms, by adding the CLTV opcode in the redeem script of an output it restricts the output, so that it can only be spent after the specified time has elapsed.

|

Tip

|

While nLocktime is a transaction-level timelock, CLTV is an output-based timelock. |

CLTV doesn’t replace nLocktime, but rather restricts specific UTXO such that they can only be spent in a future transaction with nLocktime set to a greater or equal value.

The CLTV opcode takes one parameter as input, expressed as a number in the same format as nLocktime (either a block height or Unix epoch time). As indicated by the VERIFY suffix, CLTV is the type of opcode that halts execution of the script if the outcome is FALSE. If it results in TRUE, execution continues.

In order to lock an output with CLTV, you insert it into the redeem script of the output in the transaction that creates the output. For example, if Alice is paying Bob’s address, the output would normally contain a P2PKH script like this:

DUP HASH160 <Bob's Public Key Hash> EQUALVERIFY CHECKSIG

To lock it to a time, say 3 months from now, the transaction would be a P2SH transaction with a redeem script like this:

<now + 3 months> CHECKLOCKTIMEVERIFY DROP DUP HASH160 <Bob's Public Key Hash> EQUALVERIFY CHECKSIG

where <now {plus} 3 months> is a block height or time value estimated 3 months from the time the transaction is mined: current block height + 12,960 (blocks) or current Unix epoch time + 7,760,000 (seconds). For now, don’t worry about the DROP opcode that follows CHECKLOCKTIMEVERIFY; it will be explained shortly.

When Bob tries to spend this UTXO, he constructs a transaction that references the UTXO as an input. He uses his signature and public key in the unlocking script of that input and sets the transaction nLocktime to be equal or greater to the timelock in the CHECKLOCKTIMEVERIFY Alice set. Bob then broadcasts the transaction on the bitcoin network.

Bob’s transaction is evaluated as follows. If the CHECKLOCKTIMEVERIFY parameter Alice set is less than or equal the spending transaction’s nLocktime, script execution continues (acts as if a “no operation” or NOP opcode was executed). Otherwise, script execution halts and the transaction is deemed invalid.

More precisely, CHECKLOCKTIMEVERIFY fails and halts execution, marking the transaction invalid if (source: BIP-65):

-

the stack is empty; or

-

the top item on the stack is less than 0; or

-

the lock-time type (height versus timestamp) of the top stack item and the nLocktime field are not the same; or

-

the top stack item is greater than the transaction’s nLocktime field; or

-

the nSequence field of the input is 0xffffffff.

|

Note

|

CLTV and nLocktime use the same format to describe timelocks, either a block height or the time elapsed in seconds since Unix epoch. Critically, when used together, the format of nLocktime must match that of CLTV in the outputs—they must both reference either block height or time in seconds. |

After execution, if CLTV is satisfied, the time parameter that preceded it remains as the top item on the stack and may need to be dropped, with DROP, for correct execution of subsequent script opcodes. You will often see CHECKLOCKTIMEVERIFY followed by DROP in scripts for this reason.

By using nLocktime in conjunction with CLTV, the scenario described in Transaction locktime limitations changes. Alice can no longer spend the money (because it’s locked with Bob’s key) and Bob cannot spend it before the 3-month locktime has expired.

By introducing timelock functionality directly into the scripting language, CLTV allows us to develop some very interesting complex scripts.

The standard is defined in BIP-65 (CHECKLOCKTIMEVERIFY).

Relative Timelocks

nLocktime and CLTV are both absolute timelocks in that they specify an absolute point in time. The next two timelock features we will examine are relative timelocks in that they specify, as a condition of spending an output, an elapsed time from the confirmation of the output in the blockchain.

Relative timelocks are useful because they allow a chain of two or more interdependent transactions to be held off chain, while imposing a time constraint on one transaction that is dependent on the elapsed time from the confirmation of a previous transaction. In other words, the clock doesn’t start counting until the UTXO is recorded on the blockchain. This functionality is especially useful in bidirectional state channels and Lightning Networks, as we will see in [state_channels].

Relative timelocks, like absolute timelocks, are implemented with both a transaction-level feature and a script-level opcode. The transaction-level relative timelock is implemented as a consensus rule on the value of nSequence, a transaction field that is set in every transaction input. Script-level relative timelocks are implemented with the CHECKSEQUENCEVERIFY (CSV) opcode.

Relative timelocks are implemented according to the specifications in BIP-68, Relative lock-time using consensus-enforced sequence numbers and BIP-112, CHECKSEQUENCEVERIFY.

BIP-68 and BIP-112 were activated in May 2016 as a soft fork upgrade to the consensus rules.

Relative Timelocks with nSequence

Relative timelocks can be set on each input of a transaction, by setting the nSequence field in each input.

Original meaning of nSequence

The nSequence field was originally intended (but never properly implemented) to allow modification of transactions in the mempool. In that use, a transaction containing inputs with nSequence value below 232 - 1 (0xFFFFFFFF) indicated a transaction that was not yet "finalized." Such a transaction would be held in the mempool until it was replaced by another transaction spending the same inputs with a higher nSequence value. Once a transaction was received whose inputs had an nSequence value of 0xFFFFFFFF it would be considered "finalized" and mined.

The original meaning of nSequence was never properly implemented and the value of nSequence is customarily set to 0xFFFFFFFF in transactions that do not utilize timelocks. For transactions with nLocktime or CHECKLOCKTIMEVERIFY, the nSequence value must be set to less than 231 for the timelock guards to have an effect, as explained below.

nSequence as a consensus-enforced relative timelock

Since the activation of BIP-68, new consensus rules apply for any transaction containing an input whose nSequence value is less than 231 (bit 1<<31 is not set). Programmatically, that means that if the most significant (bit 1<<31) is not set, it is a flag that means "relative locktime." Otherwise (bit 1<<31 set), the nSequence value is reserved for other uses such as enabling CHECKLOCKTIMEVERIFY, nLocktime, Opt-In-Replace-By-Fee, and other future developments.

Transaction inputs with nSequence values less than 231 are interpreted as having a relative timelock. Such a transaction is only valid once the input has aged by the relative timelock amount. For example, a transaction with one input with an nSequence relative timelock of 30 blocks is only valid when at least 30 blocks have elapsed from the time the UTXO referenced in the input was mined. Since nSequence is a per-input field, a transaction may contain any number of timelocked inputs, all of which must have sufficiently aged for the transaction to be valid. A transaction can include both timelocked inputs (nSequence < 231) and inputs without a relative timelock (nSequence >= 231).

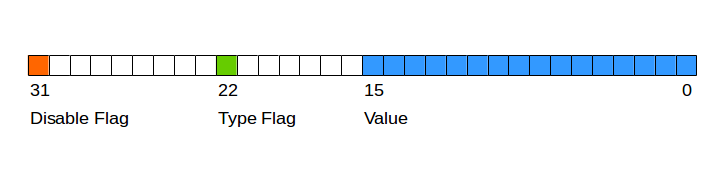

The nSequence value is specified in either blocks or seconds, but in a slightly different format than we saw used in nLocktime. A type-flag is used to differentiate between values counting blocks and values counting time in seconds. The type-flag is set in the 23rd least-significant bit (i.e., value 1<<22). If the type-flag is set, then the nSequence value is interpreted as a multiple of 512 seconds. If the type-flag is not set, the nSequence value is interpreted as a number of blocks.

When interpreting nSequence as a relative timelock, only the 16 least significant bits are considered. Once the flags (bits 32 and 23) are evaluated, the nSequence value is usually "masked" with a 16-bit mask (e.g., nSequence & 0x0000FFFF).

BIP-68 definition of nSequence encoding (Source: BIP-68) shows the binary layout of the nSequence value, as defined by BIP-68.

Relative timelocks based on consensus enforcement of the nSequence value are defined in BIP-68.

The standard is defined in BIP-68, Relative lock-time using consensus-enforced sequence numbers.

Relative Timelocks with CSV

Just like CLTV and nLocktime, there is a script opcode for relative timelocks that leverages the nSequence value in scripts. That opcode is CHECKSEQUENCEVERIFY, commonly referred to as CSV for short.

The CSV opcode when evaluated in an UTXO’s redeem script allows spending only in a transaction whose input nSequence value is greater than or equal to the CSV parameter. Essentially, this restricts spending the UTXO until a certain number of blocks or seconds have elapsed relative to the time the UTXO was mined.

As with CLTV, the value in CSV must match the format in the corresponding nSequence value. If CSV is specified in terms of blocks, then so must nSequence. If CSV is specified in terms of seconds, then so must nSequence.

Relative timelocks with CSV are especially useful when several (chained) transactions are created and signed, but not propagated, when they’re kept "off-chain." A child transaction cannot be used until the parent transaction has been propagated, mined, and aged by the time specified in the relative timelock. One application of this use case can be seen in [state_channels] and [lightning_network].

CSV is defined in detail in BIP-112, CHECKSEQUENCEVERIFY.

Median-Time-Past

As part of the activation of relative timelocks, there was also a change in the way "time" is calculated for timelocks (both absolute and relative). In bitcoin there is a subtle, but very significant, difference between wall time and consensus time. Bitcoin is a decentralized network, which means that each participant has his or her own perspective of time. Events on the network do not occur instantaneously everywhere. Network latency must be factored into the perspective of each node. Eventually everything is synchronized to create a common ledger. Bitcoin reaches consensus every 10 minutes about the state of the ledger as it existed in the past.

The timestamps set in block headers are set by the miners. There is a certain degree of latitude allowed by the consensus rules to account for differences in clock accuracy between decentralized nodes. However, this creates an unfortunate incentive for miners to lie about the time in a block so as to earn extra fees by including timelocked transactions that are not yet mature. See the following section for more information.

To remove the incentive to lie and strengthen the security of timelocks, a BIP was proposed and activated at the same time as the BIPs for relative timelocks. This is BIP-113, which defines a new consensus measurement of time called Median-Time-Past.

Median-Time-Past is calculated by taking the timestamps of the last 11 blocks and finding the median. That median time then becomes consensus time and is used for all timelock calculations. By taking the midpoint from approximately two hours in the past, the influence of any one block’s timestamp is reduced. By incorporating 11 blocks, no single miner can influence the timestamps in order to gain fees from transactions with a timelock that hasn’t yet matured.

Median-Time-Past changes the implementation of time calculations for nLocktime, CLTV, nSequence, and CSV. The consensus time calculated by Median-Time-Past is always approximately one hour behind wall clock time. If you create timelock transactions, you should account for it when estimating the desired value to encode in nLocktime, nSequence, CLTV, and CSV.

Median-Time-Past is specified in BIP-113.

Timelock Defense Against Fee Sniping

Fee-sniping is a theoretical attack scenario, where miners attempting to rewrite past blocks "snipe" higher-fee transactions from future blocks to maximize their profitability.

For example, let’s say the highest block in existence is block #100,000. If instead of attempting to mine block #100,001 to extend the chain, some miners attempt to remine #100,000. These miners can choose to include any valid transaction (that hasn’t been mined yet) in their candidate block #100,000. They don’t have to remine the block with the same transactions. In fact, they have the incentive to select the most profitable (highest fee per kB) transactions to include in their block. They can include any transactions that were in the "old" block #100,000, as well as any transactions from the current mempool. Essentially they have the option to pull transactions from the "present" into the rewritten "past" when they re-create block #100,000.

Today, this attack is not very lucrative, because block reward is much higher than total fees per block. But at some point in the future, transaction fees will be the majority of the reward (or even the entirety of the reward). At that time, this scenario becomes inevitable.

To prevent "fee sniping," when Bitcoin Core creates transactions, it uses nLocktime to limit them to the "next block," by default. In our scenario, Bitcoin Core would set nLocktime to 100,001 on any transaction it created. Under normal circumstances, this nLocktime has no effect—the transactions could only be included in block #100,001 anyway; it’s the next block.

But under a blockchain fork attack, the miners would not be able to pull high-fee transactions from the mempool, because all those transactions would be timelocked to block #100,001. They can only remine #100,000 with whatever transactions were valid at that time, essentially gaining no new fees.

To achieve this, Bitcoin Core sets the nLocktime on all new transactions to <current block # + 1> and sets the nSequence on all the inputs to 0xFFFFFFFE to enable nLocktime.

Scripts with Flow Control (Conditional Clauses)

One of the more powerful features of Bitcoin Script is flow control, also known as conditional clauses. You are probably familiar with flow control in various programming languages that use the construct IF...THEN...ELSE. Bitcoin conditional clauses look a bit different, but are essentially the same construct.

At a basic level, bitcoin conditional opcodes allow us to construct a redeem script that has two ways of being unlocked, depending on a TRUE/FALSE outcome of evaluating a logical condition. For example, if x is TRUE, the redeem script is A and the ELSE redeem script is B.

Additionally, bitcoin conditional expressions can be "nested" indefinitely, meaning that a conditional clause can contain another within it, which contains another, etc. Bitcoin Script flow control can be used to construct very complex scripts with hundreds or even thousands of possible execution paths. There is no limit to nesting, but consensus rules impose a limit on the maximum size, in bytes, of a script.

Bitcoin implements flow control using the IF, ELSE, ENDIF, and NOTIF opcodes. Additionally, conditional expressions can contain boolean operators such as BOOLAND, BOOLOR, and NOT.

At first glance, you may find the bitcoin’s flow control scripts confusing. That is because Bitcoin Script is a stack language. The same way that 1 {plus} 1 looks "backward" when expressed as 1 1 ADD, flow control clauses in bitcoin also look "backward."

In most traditional (procedural) programming languages, flow control looks like this:

if (condition): code to run when condition is true else: code to run when condition is false code to run in either case

In a stack-based language like Bitcoin Script, the logical condition comes before the IF, which makes it look "backward," like this:

condition IF code to run when condition is true ELSE code to run when condition is false ENDIF code to run in either case

When reading Bitcoin Script, remember that the condition being evaluated comes before the IF opcode.

Conditional Clauses with VERIFY Opcodes

Another form of conditional in Bitcoin Script is any opcode that ends in VERIFY. The VERIFY suffix means that if the condition evaluated is not TRUE, execution of the script terminates immediately and the transaction is deemed invalid.

Unlike an IF clause, which offers alternative execution paths, the VERIFY suffix acts as a guard clause, continuing only if a precondition is met.

For example, the following script requires Bob’s signature and a pre-image (secret) that produces a specific hash. Both conditions must be satisfied to unlock:

HASH160 <expected hash> EQUALVERIFY <Bob's Pubkey> CHECKSIG

To redeem this, Bob must construct an unlocking script that presents a valid pre-image and a signature:

<Bob's Sig> <hash pre-image>

Without presenting the pre-image, Bob can’t get to the part of the script that checks for his signature.

This script can be written with an IF instead:

HASH160 <expected hash> EQUAL IF <Bob's Pubkey> CHECKSIG ENDIF

Bob’s unlocking script is identical:

<Bob's Sig> <hash pre-image>

The script with IF does the same thing as using an opcode with a VERIFY suffix; they both operate as guard clauses. However, the VERIFY construction is more efficient, using two fewer opcodes.

So, when do we use VERIFY and when do we use IF? If all we are trying to do is to attach a precondition (guard clause), then VERIFY is better. If, however, we want to have more than one execution path (flow control), then we need an IF...ELSE flow control clause.

|

Tip

|

An opcode such as EQUAL will push the result (TRUE/FALSE) onto the stack, leaving it there for evaluation by subsequent opcodes. In contrast, the opcode EQUALVERIFY suffix does not leave anything on the stack. Opcodes that end in VERIFY do not leave the result on the stack. |

Using Flow Control in Scripts

A very common use for flow control in Bitcoin Script is to construct a redeem script that offers multiple execution paths, each a different way of redeeming the UTXO.

Let’s look at a simple example, where we have two signers, Alice and Bob, and either one is able to redeem. With multisig, this would be expressed as a 1-of-2 multisig script. For the sake of demonstration, we will do the same thing with an IF clause:

IF <Alice's Pubkey> CHECKSIG ELSE <Bob's Pubkey> CHECKSIG ENDIF

Looking at this redeem script, you may be wondering: "Where is the condition? There is nothing preceding the IF clause!"

The condition is not part of the redeem script. Instead, the condition will be offered in the unlocking script, allowing Alice and Bob to "choose" which execution path they want.

Alice redeems this with the unlocking script:

<Alice's Sig> 1

The 1 at the end serves as the condition (TRUE) that will make the IF clause execute the first redemption path for which Alice has a signature.

For Bob to redeem this, he would have to choose the second execution path by giving a FALSE value to the IF clause:

<Bob's Sig> 0

Bob’s unlocking script puts a 0 on the stack, causing the IF clause to execute the second (ELSE) script, which requires Bob’s signature.

Since IF clauses can be nested, we can create a "maze" of execution paths. The unlocking script can provide a "map" selecting which execution path is actually executed:

IF

script A

ELSE

IF

script B

ELSE

script C

ENDIF

ENDIF

In this scenario, there are three execution paths (script A, script B, and script C). The unlocking script provides a path in the form of a sequence of TRUE or FALSE values. To select path script B, for example, the unlocking script must end in 1 0 (TRUE, FALSE). These values will be pushed onto the stack, so that the second value (FALSE) ends up at the top of the stack. The outer IF clause pops the FALSE value and executes the first ELSE clause. Then the TRUE value moves to the top of the stack and is evaluated by the inner (nested) IF, selecting the B execution path.

Using this construct, we can build redeem scripts with tens or hundreds of execution paths, each offering a different way to redeem the UTXO. To spend, we construct an unlocking script that navigates the execution path by putting the appropriate TRUE and FALSE values on the stack at each flow control point.

Complex Script Example

In this section we combine many of the concepts from this chapter into a single example.

Our example uses the story of Mohammed, the company owner in Dubai who is operating an import/export business.

In this example, Mohammed wishes to construct a company capital account with flexible rules. The scheme he creates requires different levels of authorization depending on timelocks. The participants in the multisig scheme are Mohammed, his two partners Saeed and Zaira, and their company lawyer Abdul. The three partners make decisions based on a majority rule, so two of the three must agree. However, in the case of a problem with their keys, they want their lawyer to be able to recover the funds with one of the three partner signatures. Finally, if all partners are unavailable or incapacitated for a while, they want the lawyer to be able to manage the account directly.

Here’s the redeem script that Mohammed designs to achieve this (line number prefix as XX):

01 IF 02 IF 03 2 04 ELSE 05 <30 days> CHECKSEQUENCEVERIFY DROP 06 <Abdul the Lawyer's Pubkey> CHECKSIGVERIFY 07 1 08 ENDIF 09 <Mohammed's Pubkey> <Saeed's Pubkey> <Zaira's Pubkey> 3 CHECKMULTISIG 10 ELSE 11 <90 days> CHECKSEQUENCEVERIFY DROP 12 <Abdul the Lawyer's Pubkey> CHECKSIG 13 ENDIF

Mohammed’s script implements three execution paths using nested IF...ELSE flow control clauses.

In the first execution path, this script operates as a simple 2-of-3 multisig with the three partners. This execution path consists of lines 3 and 9. Line 3 sets the quorum of the multisig to 2 (2-of-3). This execution path can be selected by putting TRUE TRUE at the end of the unlocking script:

0 <Mohammed's Sig> <Zaira's Sig> TRUE TRUE

|

Tip

|

The 0 at the beginning of this unlocking script is because of a bug in CHECKMULTISIG that pops an extra value from the stack. The extra value is disregarded by the CHECKMULTISIG, but it must be present or the script fails. Pushing 0 (customarily) is a workaround to the bug, as described in A bug in CHECKMULTISIG execution. |

The second execution path can only be used after 30 days have elapsed from the creation of the UTXO. At that time, it requires the signature of Abdul the lawyer and one of the three partners (a 1-of-3 multisig). This is achieved by line 7, which sets the quorum for the multisig to 1. To select this execution path, the unlocking script would end in FALSE TRUE:

0 <Saeed's Sig> <Abdul's Sig> FALSE TRUE

|

Tip

|

Why FALSE TRUE? Isn’t that backward? Because the two values are pushed on to the stack, with FALSE pushed first, then TRUE pushed second. TRUE is therefore popped first by the first IF opcode. |

Finally, the third execution path allows Abdul the lawyer to spend the funds alone, but only after 90 days. To select this execution path, the unlocking script has to end in FALSE:

<Abdul's Sig> FALSE

Try running the script on paper to see how it behaves on the stack.

A few more things to consider when reading this example. See if you can find the answers:

-

Why can’t the lawyer redeem the third execution path at any time by selecting it with FALSE on the unlocking script?

-

How many execution paths can be used 5, 35, and 105 days, respectively, after the UTXO is mined?

-

Are the funds lost if the lawyer loses his key? Does your answer change if 91 days have elapsed?

-

How do the partners "reset" the clock every 29 or 89 days to prevent the lawyer from accessing the funds?

-

Why do some CHECKSIG opcodes in this script have the VERIFY suffix while others don’t?

Segregated Witness

Segregated Witness (segwit) is an upgrade to the bitcoin consensus rules and network protocol, proposed and implemented as a BIP-9 soft-fork that was activated on bitcoin’s mainnet on August 1st, 2017.

In cryptography, the term "witness" is used to describe a solution to a cryptographic puzzle. In bitcoin terms, the witness satisfies a cryptographic condition placed on a unspent transaction output (UTXO).

In the context of bitcoin, a digital signature is one type of witness, but a witness is more broadly any solution that can satisfy the conditions imposed on an UTXO and unlock that UTXO for spending. The term “witness” is a more general term for an “unlocking script” or “scriptSig.”

Before segwit’s introduction, every input in a transaction was followed by the witness data that unlocked it. The witness data was embedded in the transaction as part of each input. The term segregated witness, or segwit for short, simply means separating the signature or unlocking script of a specific output. Think "separate scriptSig," or “separate signature” in the simplest form.

Segregated Witness therefore is an architectural change to bitcoin that aims to move the witness data from the scriptSig (unlocking script) field of a transaction into a separate witness data structure that accompanies a transaction. Clients may request transaction data with or without the accompanying witness data.

In this section we will look at some of the benefits of Segregated Witness, describe the mechanism used to deploy and implement this architecture change, and demonstrate the use of Segregated Witness in transactions and addresses.

Segregated Witness is defined by the following BIPs:

- BIP-141

-

The main definition of Segregated Witness.

- BIP-143

-

Transaction Signature Verification for Version 0 Witness Program

- BIP-144

-

Peer Services—New network messages and serialization formats

- BIP-145

-

getblocktemplate Updates for Segregated Witness (for mining)

- BIP-173

-

Base32 address format for native v0-16 witness outputs

Why Segregated Witness?

Segregated Witness is an architectural change that has several effects on the scalability, security, economic incentives, and performance of bitcoin:

- Transaction Malleability

-

By moving the witness outside the transaction, the transaction hash used as an identifier no longer includes the witness data. Since the witness data is the only part of the transaction that can be modified by a third party (see Transaction identifiers), removing it also removes the opportunity for transaction malleability attacks. With Segregated Witness, transaction hashes become immutable by anyone other than the creator of the transaction, which greatly improves the implementation of many other protocols that rely on advanced bitcoin transaction construction, such as payment channels, chained transactions, and lightning networks.

- Script Versioning

-

With the introduction of Segregated Witness scripts, every locking script is preceded by a script version number, similar to how transactions and blocks have version numbers. The addition of a script version number allows the scripting language to be upgraded in a backward-compatible way (i.e., using soft fork upgrades) to introduce new script operands, syntax, or semantics. The ability to upgrade the scripting language in a nondisruptive way will greatly accelerate the rate of innovation in bitcoin.

- Network and Storage Scaling

-

The witness data is often a big contributor to the total size of a transaction. More complex scripts such as those used for multisig or payment channels are very large. In some cases these scripts account for the majority (more than 75%) of the data in a transaction. By moving the witness data outside the transaction, Segregated Witness improves bitcoin’s scalability. Nodes can prune the witness data after validating the signatures, or ignore it altogether when doing simplified payment verification. The witness data doesn’t need to be transmitted to all nodes and does not need to be stored on disk by all nodes.

- Signature Verification Optimization

-

Segregated Witness upgrades the signature functions (CHECKSIG, CHECKMULTISIG, etc.) to reduce the algorithm’s computational complexity. Before segwit, the algorithm used to produce a signature required a number of hash operations that was proportional to the size of the transaction. Data-hashing computations increased in O(n2) with respect to the number of signature operations, introducing a substantial computational burden on all nodes verifying the signature. With segwit, the algorithm is changed to reduce the complexity to O(n).

- Offline Signing Improvement

-

Segregated Witness signatures incorporate the value (amount) referenced by each input in the hash that is signed. Previously, an offline signing device, such as a hardware wallet, would have to verify the amount of each input before signing a transaction. This was usually accomplished by streaming a large amount of data about the previous transactions referenced as inputs. Since the amount is now part of the commitment hash that is signed, an offline device does not need the previous transactions. If the amounts do not match (are misrepresented by a compromised online system), the signature will be invalid.

How Segregated Witness Works

At first glance, Segregated Witness appears to be a change to how transactions are constructed and therefore a transaction-level feature, but it is not. Rather, Segregated Witness is a change to how individual UTXO are spent and therefore is a per-output feature.

A transaction can spend Segregated Witness outputs or traditional (inline-witness) outputs or both. Therefore, it does not make much sense to refer to a transaction as a “Segregated Witness transaction.” Rather we should refer to specific transaction outputs as “Segregated Witness outputs."

When a transaction spends an UTXO, it must provide a witness. In a traditional UTXO, the locking script requires that witness data be provided inline in the input part of the transaction that spends the UTXO. A Segregated Witness UTXO, however, specifies a locking script that can be satisfied with witness data outside of the input (segregated).

Soft Fork (Backward Compatibility)

Segregated Witness is a significant change to the way outputs and transactions are architected. Such a change would normally require a simultaneous change in every bitcoin node and wallet to change the consensus rules—what is known as a hard fork. Instead, segregated witness is introduced with a much less disruptive change, which is backward compatible, known as a soft fork. This type of upgrade allows nonupgraded software to ignore the changes and continue to operate without any disruption.

Segregated Witness outputs are constructed so that older systems that are not segwit-aware can still validate them. To an old wallet or node, a Segregated Witness output looks like an output that anyone can spend. Such outputs can be spent with an empty signature, therefore the fact that there is no signature inside the transaction (it is segregated) does not invalidate the transaction. Newer wallets and mining nodes, however, see the Segregated Witness output and expect to find a valid witness for it in the transaction’s witness data.

Segregated Witness Output and Transaction Examples

Let’s look at some of our example transactions and see how they would change with Segregated Witness. We’ll first look at how a Pay-to-Public-Key-Hash (P2PKH) payment is transformed with the Segregated Witness program. Then, we’ll look at the Segregated Witness equivalent for Pay-to-Script-Hash (P2SH) scripts. Finally, we’ll look at how both of the preceding Segregated Witness programs can be embedded inside a P2SH script.

Pay-to-Witness-Public-Key-Hash (P2WPKH)

In [cup_of_coffee], Alice created a transaction to pay Bob for a cup of coffee. That transaction created a P2PKH output with a value of 0.015 BTC that was spendable by Bob. The output’s script looks like this:

DUP HASH160 ab68025513c3dbd2f7b92a94e0581f5d50f654e7 EQUALVERIFY CHECKSIG

With Segregated Witness, Alice would create a Pay-to-Witness-Public-Key-Hash (P2WPKH) script, which looks like this:

0 ab68025513c3dbd2f7b92a94e0581f5d50f654e7

As you can see, a Segregated Witness output’s locking script is much simpler than a traditional output. It consists of two values that are pushed on to the script evaluation stack. To an old (nonsegwit-aware) bitcoin client, the two pushes would look like an output that anyone can spend and does not require a signature (or rather, can be spent with an empty signature). To a newer, segwit-aware client, the first number (0) is interpreted as a version number (the witness version) and the second part (20 bytes) is the equivalent of a locking script known as a witness program. The 20-byte witness program is simply the hash of the public key, as in a P2PKH script

Now, let’s look at the corresponding transaction that Bob uses to spend this output. For the original script (nonsegwit), Bob’s transaction would have to include a signature within the transaction input:

[...]

“Vin” : [

"txid": "0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2",

"vout": 0,

"scriptSig": “<Bob’s scriptSig>”,

]

[...]

However, to spend the Segregated Witness output, the transaction has no signature on that input. Instead, Bob’s transaction has an empty scriptSig and includes a Segregated Witness, outside the transaction itself:

[...]

“Vin” : [

"txid": "0627052b6f28912f2703066a912ea577f2ce4da4caa5a5fbd8a57286c345c2f2",

"vout": 0,

"scriptSig": “”,

]

[...]

“witness”: “<Bob’s witness data>”

[...]

Wallet construction of P2WPKH

It is extremely important to note that P2WPKH should only be created by the payee (recipient) and not converted by the sender from a known public key, P2PKH script, or address. The sender has no way of knowing if the recipient’s wallet has the ability to construct segwit transactions and spend P2WPKH outputs.

Additionally, P2WPKH outputs must be constructed from the hash of a compressed public key. Uncompressed public keys are nonstandard in segwit and may be explicitly disabled by a future soft fork. If the hash used in the P2WPKH came from an uncompressed public key, it may be unspendable and you may lose funds. P2WPKH outputs should be created by the payee’s wallet by deriving a compressed public key from their private key.

|

Warning

|

P2WPKH should be constructed by the payee (recipient) by converting a compressed public key to a P2WPKH hash. You should never transform a P2PKH script, bitcoin address, or uncompressed public key to a P2WPKH witness script. |

Pay-to-Witness-Script-Hash (P2WSH)

The second type of witness program corresponds to a Pay-to-Script-Hash (P2SH) script. We saw this type of script in Pay-to-Script-Hash (P2SH). In that example, P2SH was used by Mohammed’s company to express a multisignature script. Payments to Mohammed’s company were encoded with a locking script like this:

HASH160 54c557e07dde5bb6cb791c7a540e0a4796f5e97e EQUAL

This P2SH script references the hash of a redeem script that defines a 2-of-3 multisignature requirement to spend funds. To spend this output, Mohammed’s company would present the redeem script (whose hash matches the script hash in the P2SH output) and the signatures necessary to satisfy that redeem script, all inside the transaction input:

[...]

“Vin” : [

"txid": "abcdef12345...",

"vout": 0,

"scriptSig": “<SigA> <SigB> <2 PubA PubB PubC PubD PubE 5 CHECKMULTISIG>”,

]

Now, let’s look at how this entire example would be upgraded to segwit. If Mohammed’s customers were using a segwit-compatible wallet, they would make a payment, creating a Pay-to-Witness-Script-Hash (P2WSH) output that would look like this:

0 a9b7b38d972cabc7961dbfbcb841ad4508d133c47ba87457b4a0e8aae86dbb89

Again, as with the example of P2WPKH, you can see that the Segregated Witness equivalent script is a lot simpler and omits the various script operands that you see in P2SH scripts. Instead, the Segregated Witness program consists of two values pushed to the stack: a witness version (0) and the 32-byte SHA256 hash of the redeem script.

|

Tip

|

While P2SH uses the 20-byte RIPEMD160(SHA256(script)) hash, the P2WSH witness program uses a 32-byte SHA256(script) hash. This difference in the selection of the hashing algorithm is deliberate and is used to differentiate between the two types of witness programs (P2WPKH and P2WSH) by the length of the hash and to provide stronger security to P2WSH (128 bits of security in P2WSH versus 80 bits of security in P2SH). |

Mohammed’s company can spend outputs the P2WSH output by presenting the correct redeem script and sufficient signatures to satisfy it. Both the redeem script and the signatures would be segregated outside the spending transaction as part of the witness data. Within the transaction input, Mohammed’s wallet would put an empty scriptSig:

[...]

“Vin” : [

"txid": "abcdef12345...",

"vout": 0,

"scriptSig": “”,

]

[...]

“witness”: “<SigA> <SigB> <2 PubA PubB PubC PubD PubE 5 CHECKMULTISIG>”

[...]

Differentiating between P2WPKH and P2WSH

In the previous two sections, we demonstrated two types of witness programs: Pay-to-Witness-Public-Key-Hash (P2WPKH) and Pay-to-Witness-Script-Hash (P2WSH). Both types of witness programs consist of a single byte version number followed by a longer hash. They look very similar, but are interpreted very differently: one is interpreted as a public key hash, which is satisfied by a signature and the other as a script hash, which is satisfied by a redeem script. The critical difference between them is the length of the hash:

-

The public key hash in P2WPKH is 20 bytes

-

The script hash in P2WSH is 32 bytes

This is the one difference that allows a wallet to differentiate between the two types of witness programs. By looking at the length of the hash, a wallet can determine what type of witness program it is, P2WPKH or P2WSH.

Upgrading to Segregated Witness

As we can see from the previous examples, upgrading to Segregated Witness is a two-step process. First, wallets must create special segwit type outputs. Then, these outputs can be spent by wallets that know how to construct Segregated Witness transactions. In the examples, Alice’s wallet was segwit-aware and able to create special outputs with Segregated Witness scripts. Bob’s wallet is also segwit-aware and able to spend those outputs. What may not be obvious from the example is that in practice, Alice’s wallet needs to know that Bob uses a segwit-aware wallet and can spend these outputs. Otherwise, if Bob’s wallet is not upgraded and Alice tries to make segwit payments to Bob, Bob’s wallet will not be able to detect these payments.

|

Tip

|

For P2WPKH and P2WSH payment types, both the sender and the recipient wallets need to be upgraded to be able to use segwit. Furthermore, the sender’s wallet needs to know that the recipient’s wallet is segwit-aware. |

Segregated Witness will not be implemented simultaneously across the entire network. Rather, Segregated Witness is implemented as a backward-compatible upgrade, where old and new clients can coexist. Wallet developers will independently upgrade wallet software to add segwit capabilities. The P2WPKH and P2WSH payment types are used when both sender and recipient are segwit-aware. The traditional P2PKH and P2SH will continue to work for nonupgraded wallets. That leaves two important scenarios, which are addressed in the next section:

-

Ability of a sender’s wallet that is not segwit-aware to make a payment to a recipient’s wallet that can process segwit transactions

-

Ability of a sender’s wallet that is segwit-aware to recognize and distinguish between recipients that are segwit-aware and ones that are not, by their addresses.

Embedding Segregated Witness inside P2SH

Let’s assume, for example, that Alice’s wallet is not upgraded to segwit, but Bob’s wallet is upgraded and can handle segwit transactions. Alice and Bob can use "old" non-segwit transactions. But Bob would likely want to use segwit to reduce transaction fees, taking advantage of the discount that applies to witness data.

In this case Bob’s wallet can construct a P2SH address that contains a segwit script inside it. Alice’s wallet sees this as a "normal" P2SH address and can make payments to it without any knowledge of segwit. Bob’s wallet can then spend this payment with a segwit transaction, taking full advantage of segwit and reducing transaction fees.

Both forms of witness scripts, P2WPKH and P2WSH, can be embedded in a P2SH address. The first is noted as P2SH(P2WPKH) and the second is noted as P2SH(P2WSH).

Pay-to-Witness-Public-Key-Hash inside Pay-to-Script-Hash

The first form of witness script we will examine is P2SH(P2WPKH). This is a Pay-to-Witness-Public-Key-Hash witness program, embedded inside a Pay-to-Script-Hash script, so that it can be used by a wallet that is not aware of segwit.

Bob’s wallet constructs a P2WPKH witness program with Bob’s public key. This witness program is then hashed and the resulting hash is encoded as a P2SH script. The P2SH script is converted to a bitcoin address, one that starts with a "3," as we saw in the Pay-to-Script-Hash (P2SH) section.

Bob’s wallet starts with the P2WPKH witness program we saw earlier:

0 ab68025513c3dbd2f7b92a94e0581f5d50f654e7

The P2WPKH witness program consists of the witness version and Bob’s 20-byte public key hash.

Bob’s wallet then hashes the preceding witness program, first with SHA256, then with RIPEMD160, producing another 20-byte hash.

Let’s use bx on the command-line to replicate that:

echo \ '0 [ab68025513c3dbd2f7b92a94e0581f5d50f654e7]'\ | bx script-encode | bx sha256 | bx ripemd160 3e0547268b3b19288b3adef9719ec8659f4b2b0b

Next, the redeem script hash is converted to a bitcoin address. Let’s use bx on the command-line again:

echo \ '3e0547268b3b19288b3adef9719ec8659f4b2b0b' \ | bx address-encode -v 5 37Lx99uaGn5avKBxiW26HjedQE3LrDCZru

Now, Bob can display this address for customers to pay for their coffee. Alice’s wallet can make a payment to 37Lx99uaGn5avKBxiW26HjedQE3LrDCZru, just as it would to any other bitcoin address.

To pay Bob, Alice’s wallet would lock the output with a P2SH script:

HASH160 3e0547268b3b19288b3adef9719ec8659f4b2b0b EQUAL

Even though Alice’s wallet has no support for segwit, the payment it creates can be spent by Bob with a segwit transaction.

Pay-to-Witness-Script-Hash inside Pay-to-Script-Hash

Similarly, a P2WSH witness program for a multisig script or other complicated script can be embedded inside a P2SH script and address, making it possible for any wallet to make payments that are segwit compatible.

As we saw in Pay-to-Witness-Script-Hash (P2WSH), Mohammed’s company is using Segregated Witness payments to multisignature scripts. To make it possible for any client to pay his company, regardless of whether their wallets are upgraded for segwit, Mohammed’s wallet can embed the P2WSH witness program inside a P2SH script.

First, Mohammed’s wallet hashes the redeem script with SHA256 (just once). Let’s use bx to do that on the command-line:

echo \ 2 \ [04C16B8698A9ABF84250A7C3EA7EEDEF9897D1C8C6ADF47F06CF73370D74DCCA01CDCA79DCC5C395D7EEC6984D83F1F50C900A24DD47F569FD4193AF5DE762C587] \ [04A2192968D8655D6A935BEAF2CA23E3FB87A3495E7AF308EDF08DAC3C1FCBFC2C75B4B0F4D0B1B70CD2423657738C0C2B1D5CE65C97D78D0E34224858008E8B49] \ [047E63248B75DB7379BE9CDA8CE5751D16485F431E46117B9D0C1837C9D5737812F393DA7D4420D7E1A9162F0279CFC10F1E8E8F3020DECDBC3C0DD389D9977965] \ [0421D65CBD7149B255382ED7F78E946580657EE6FDA162A187543A9D85BAAA93A4AB3A8F044DADA618D087227440645ABE8A35DA8C5B73997AD343BE5C2AFD94A5] \ [043752580AFA1ECED3C68D446BCAB69AC0BA7DF50D56231BE0AABF1FDEEC78A6A45E394BA29A1EDF518C022DD618DA774D207D137AAB59E0B000EB7ED238F4D800] \ 5 CHECKMULTISIG \ | bx script-encode | bx sha256 9592d601848d04b172905e0ddb0adde59f1590f1e553ffc81ddc4b0ed927dd73

Next, the hashed redeem script is turned into a P2WSH witness program:

0 9592d601848d04b172905e0ddb0adde59f1590f1e553ffc81ddc4b0ed927dd73

Then, the witness program itself is hashed with SHA256 and RIPEMD160, producing a new 20-byte hash, as used in traditional P2SH. Let’s use bx on the command-line to do that:

echo \ '0 [9592d601848d04b172905e0ddb0adde59f1590f1e553ffc81ddc4b0ed927dd73]'\ | bx script-encode | bx sha256 | bx ripemd160 86762607e8fe87c0c37740cddee880988b9455b2

Next, the wallet constructs a P2SH bitcoin address from this hash. Again, we use bx to calculate on the command-line:

echo \ '86762607e8fe87c0c37740cddee880988b9455b2'\ | bx address-encode -v 5 3Dwz1MXhM6EfFoJChHCxh1jWHb8GQqRenG

Now, Mohammed’s clients can make payments to this address without any need to support segwit. To send a payment to Mohammed, a wallet would lock the output with the following P2SH script:

HASH160 86762607e8fe87c0c37740cddee880988b9455b2 EQUAL

Mohammed’s company can then construct segwit transactions to spend these payments, taking advantage of segwit features including lower transaction fees.

Segregated Witness addresses

Even after segwit activation, it will take some time until most wallets are upgraded. At first, segwit will be embedded in P2SH, as we saw in the previous section, to ease compatibility between segwit-aware and unaware wallets.

However, once wallets are broadly supporting segwit, it makes sense to encode witness scripts directly in a native address format designed for segwit, rather than embed it in P2SH.

The native segwit address format is defined in BIP-173:

- BIP-173

-

Base32 address format for native v0-16 witness outputs

BIP-173 only encodes witness (P2WPKH and P2WSH) scripts. It is not compatible with non-segwit P2PKH or P2SH scripts. BIP-173 is a checksummed Base32 encoding, as compared to the Base58 encoding of a "traditional" bitcoin address. BIP-173 addesses are also called bech32 addresses, pronounced "beh-ch thirty two", alluding to the use of a "BCH" error detection algorithm and 32-character encoding set.

BIP-173 addresses use 32 lower-case-only alphanumeric character set, carefully selected to reduce errors from misreading or mistyping. By choosing a lower-case-only character set, bech32 is easier to read, speak, and 45% more efficient to encode in QR codes.

The BCH error detection algorithm is a vast improvement over the previous checksum algorithm (from Base58Check), allowing not only detection but also correction of errors. Address-input interfaces (such as text-fields in forms) can detect and highlight which character was most likely mistyped when they detect an error.

From the BIP-173 specification, here are some examples of bech32 addresses:

- Mainnet P2WPKH

-

bc1qw508d6qejxtdg4y5r3zarvary0c5xw7kv8f3t4

- Testnet P2WPKH

-

tb1qw508d6qejxtdg4y5r3zarvary0c5xw7kxpjzsx

- Mainnet P2WSH

-

bc1qrp33g0q5c5txsp9arysrx4k6zdkfs4nce4xj0gdcccefvpysxf3qccfmv3

- Testnet P2WSH

-

tb1qrp33g0q5c5txsp9arysrx4k6zdkfs4nce4xj0gdcccefvpysxf3q0sl5k7

As you can see in these examples, a segwit bech32 string is up to 90 characters long and consists of three parts:

- The human readable part

-

This prefix "bc" or "tb" identifying mainnet or testnet.

- The separator

-

The digit "1", which is not part of the 32-character encoding set and can only appear in this position as a separator

- The data part

-

A minimum of 6 alphanumeric characters, the checksum encoded witness script

At this time, only a few wallets accept or produce native segwit bech32 addresses, but as segwit adoption increases, you will see these more and more often.

Transaction identifiers

One of the greatest benefits of Segregated Witness is that it eliminates third-party transaction malleability.

Before segwit, transactions could have their signatures subtly modified by third parties, changing their transaction ID (hash) without changing any fundamental properties (inputs, outputs, amounts). This created opportunities for denial-of-service attacks as well as attacks against poorly written wallet software that assumed unconfirmed transaction hashes were immutable.

With the introduction of Segregated Witness, transactions have two identifiers, txid and wtxid. The traditional transaction ID txid is the double-SHA256 hash of the serialized transaction, without the witness data. A transaction wtxid is the double-SHA256 hash of the new serialization format of the transaction with witness data.

The traditional txid is calculated in exactly the same way as with a nonsegwit transaction. However, since the segwit transaction has empty scriptSigs in every input, there is no part of the transaction that can be modified by a third party. Therefore, in a segwit transaction, the txid is immutable by a third party, even when the transaction is unconfirmed.

The wtxid is like an "extended" ID, in that the hash also incorporates the witness data. If a transaction is transmitted without witness data, then the wtxid and txid are identical. Note that since the wtxid includes witness data (signatures) and since witness data may be malleable, the wtxid should be considered malleable until the transaction is confirmed. Only the txid of a segwit transaction can be considered immutable by third parties and only if all the inputs of the transaction are segwit inputs.

|

Tip

|

Segregated Witness transactions have two IDs: txid and wtxid. The txid is the hash of the transaction without the witness data and the wtxid is the hash inclusive of witness data. The txid of a transaction where all inputs are segwit inputs is not susceptible to third-party transaction malleability. |

Segregated Witness' New Signing Algorithm

Segregated Witness modifies the semantics of the four signature verification functions (CHECKSIG, CHECKSIGVERIFY, CHECKMULTISIG, and CHECKMULTISIGVERIFY), changing the way a transaction commitment hash is calculated.

Signatures in bitcoin transactions are applied on a commitment hash, which is calculated from the transaction data, locking specific parts of the data indicating the signer’s commitment to those values. For example, in a simple SIGHASH_ALL type signature, the commitment hash includes all inputs and outputs.

Unfortunately, the way the commitment hash was calculated introduced the possibility that a node verifying the signature can be forced to perform a significant number of hash computations. Specifically, the hash operations increase in O(n2) with respect to the number of signature operations in the transaction. An attacker could therefore create a transaction with a very large number of signature operations, causing the entire bitcoin network to have to perform hundreds or thousands of hash operations to verify the transaction.

Segwit represented an opportunity to address this problem by changing the way the commitment hash is calculated. For segwit version 0 witness programs, signature verification occurs using an improved commitment hash algorithm as specified in BIP-143.

The new algorithm achieves two important goals. Firstly, the number of hash operations increases by a much more gradual O(n) to the number of signature operations, reducing the opportunity to create denial-of-service attacks with overly complex transactions. Secondly, the commitment hash now also includes the value (amounts) of each input as part of the commitment. This means that a signer can commit to a specific input value without needing to "fetch" and check the previous transaction referenced by the input. In the case of offline devices, such as hardware wallets, this greatly simplifies the communication between the host and the hardware wallet, removing the need to stream previous transactions for validation. A hardware wallet can accept the input value "as stated" by an untrusted host. Since the signature is invalid if that input value is not correct, the hardware wallet doesn’t need to validate the value before signing the input.

Economic Incentives for Segregated Witness

Bitcoin mining nodes and full nodes incur costs for the resources used to support the bitcoin network and the blockchain. As the volume of bitcoin transactions increases, so does the cost of resources (CPU, network bandwidth, disk space, memory). Miners are compensated for these costs through fees that are proportional to the size (in bytes) of each transaction. Nonmining full nodes are not compensated, so they incur these costs because they have a need to run an authoritative fully validating full-index node, perhaps because they use the node to operate a bitcoin business.